Get the free private registered bonded promissory note form

Show details

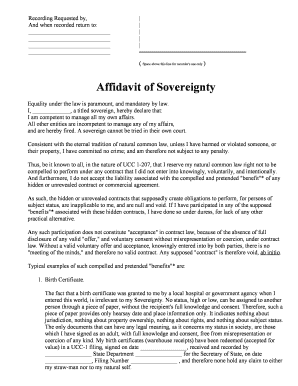

PRIVATE REGISTERED BONDED PROMISSORY NOTE

$55,000,000.00NEGOTIABLENEGOTIABLEFiftyfive Million and 00/100 United States DollarsNOTE NUMBER JHDPN0001

USO REGISTERED MAIL # RR987654321US

Pay To The Order

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your private registered bonded promissory form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private registered bonded promissory form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing private registered bonded promissory note online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bonded promissory note form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out private registered bonded promissory

How to fill out private registered bonded promissory:

01

Gather the necessary information: You will need to have all the relevant details, such as the borrower's name, the lender's name, the loan amount, and any applicable interest rates or repayment terms.

02

Obtain a promissory note template: Look for a private registered bonded promissory note template online or consult with a legal professional who can provide you with the necessary document.

03

Fill in the borrower's information: Begin by entering the borrower's name, address, and contact information. Make sure to include accurate and up-to-date details to ensure smooth communication.

04

Specify the loan details: Enter the loan amount, the date when the loan is made, and any applicable interest rates or repayment terms. It is important to clearly state the terms of the loan to avoid any confusion or disputes in the future.

05

Include security or collateral details: If there is any security or collateral attached to the loan, make sure to describe it in this section. Mention any assets or properties that are being used as security for the loan.

06

State the repayment terms: Outline the repayment plan, including the payment schedule, due dates, and any penalties for late payments. Be clear and specific to allow both parties to understand their obligations and responsibilities.

07

Obtain signatures: Once the promissory note is filled out, the borrower and lender must sign the document. This signifies their agreement to the terms and conditions stated in the promissory note.

Who needs private registered bonded promissory:

01

Individuals lending money: Private registered bonded promissory notes are often used by individuals who want to lend money to others. This could be friends, family members, or even business associates.

02

Borrowers seeking secured loans: Borrowers who are willing to provide security or collateral for a loan may opt for a private registered bonded promissory note. This type of document offers a legal framework and protection for both parties involved.

03

Parties involved in high-value transactions: Private registered bonded promissory notes are particularly useful in high-value transactions where substantial amounts of money are being borrowed or lent. It adds an extra layer of security and ensures the terms of the loan are well-documented.

Note: It is always advisable to consult with a legal professional before entering into any financial agreement or signing any document to ensure compliance with local laws and regulations.

Fill form : Try Risk Free

People Also Ask about private registered bonded promissory note

Can I make my own promissory note?

Do promissory notes have to be registered?

What is a bonded promissory note?

Does promissory note need to be recorded?

How do you write a legally binding promissory note?

What makes a promissory note invalid?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file private registered bonded promissory?

The borrower is responsible for filing a private registered bonded promissory note, which is an agreement between the borrower and the lender that outlines the terms of a loan, including the interest rate, payment schedule, and any other requirements. The filing of the note is required to ensure that the loan is legally enforceable.

How to fill out private registered bonded promissory?

1. Begin by writing the date, the amount of the loan, and the name of the borrower and lender.

2. Include the interest rate and payment schedule.

3. Specify the terms of the loan, such as the collateral to be used to secure the loan, any penalties for late payments, and the consequences of defaulting on the loan.

4. Include a statement that the loan is a private, registered, and bonded promissory note.

5. Sign and date the promissory note.

6. Have the note notarized by a notary public.

7. Make sure both parties keep a copy of the signed and notarized note.

What information must be reported on private registered bonded promissory?

A private registered bonded promissory note must include the name and address of the lender, the name and address of the borrower, the date of the loan, the amount of the loan, the interest rate, payment terms, and any other collateral that may be pledged. It must also include the signature of both the lender and the borrower, along with the signature of a witness. The note must also include the registered bond number, which serves as proof of registration.

When is the deadline to file private registered bonded promissory in 2023?

The deadline to file a private registered bonded promissory note in 2023 will depend on the specific terms of the note. Generally, the note must be filed with the appropriate government agency before the due date of the loan.

What is the penalty for the late filing of private registered bonded promissory?

The penalty for late filing of private registered bonded promissory notes can vary depending on the terms of the promissory note in question. Generally, the penalty for late filing will include late payment charges and any other stated fees that were agreed on in the promissory note. In some cases, the court may also impose additional penalties or sanctions.

What is private registered bonded promissory?

A private registered bonded promissory note is a financial document that represents a promise to repay a debt. It is legally binding and typically involves a private agreement or contract between two parties. The term "registered" indicates that the promissory note is recorded in a public registry or with a governmental authority. "Bonded" suggests that the note is backed by a bond or surety, which may offer additional security to the lender or holder of the note in case of default by the borrower.

What is the purpose of private registered bonded promissory?

A private registered bonded promissory note is a financial instrument used as a means of borrowing or lending money. It serves as a legally binding agreement between a borrower and a lender. The purpose of such a promissory note can vary depending on the specific circumstances, but some common purposes include:

1. Debt financing: It can be used as a way for individuals or businesses to access funds by borrowing money from private lenders instead of traditional financial institutions like banks.

2. Real estate transactions: Private registered bonded promissory notes can be utilized in real estate deals, where one party provides a loan to another for purchasing or refinancing a property.

3. Investment opportunities: Private lenders may use promissory notes to invest their money by providing loans to individuals or businesses, receiving interest payments in return.

4. Asset-backed lending: A private registered bonded promissory note can be secured by a specific asset, such as real estate, vehicles, or equipment, ensuring the lender has collateral in case of default.

5. Alternative financing: Some individuals or businesses may opt for private registered bonded promissory notes as an alternative to traditional loans, especially if they can't qualify for bank loans due to poor credit or other reasons.

It is important to note that the specifics of a private registered bonded promissory note can vary based on the terms and conditions agreed upon by the parties involved. Additionally, its legality and enforceability may depend on local laws and regulations. Consulting with a legal professional is recommended when dealing with such financial instruments.

How do I execute private registered bonded promissory note online?

Filling out and eSigning bonded promissory note form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit us bonded promissory note in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing bonded promissory note and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit private registered bonded promissory note on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign bonded promissory note form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your private registered bonded promissory online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Bonded Promissory Note is not the form you're looking for?Search for another form here.

Keywords relevant to bonded promissory note form

Related to bonded promissory note

If you believe that this page should be taken down, please follow our DMCA take down process

here

.